If you own property in Toronto, you know the drill—but this is one deadline you absolutely cannot afford to let slide.

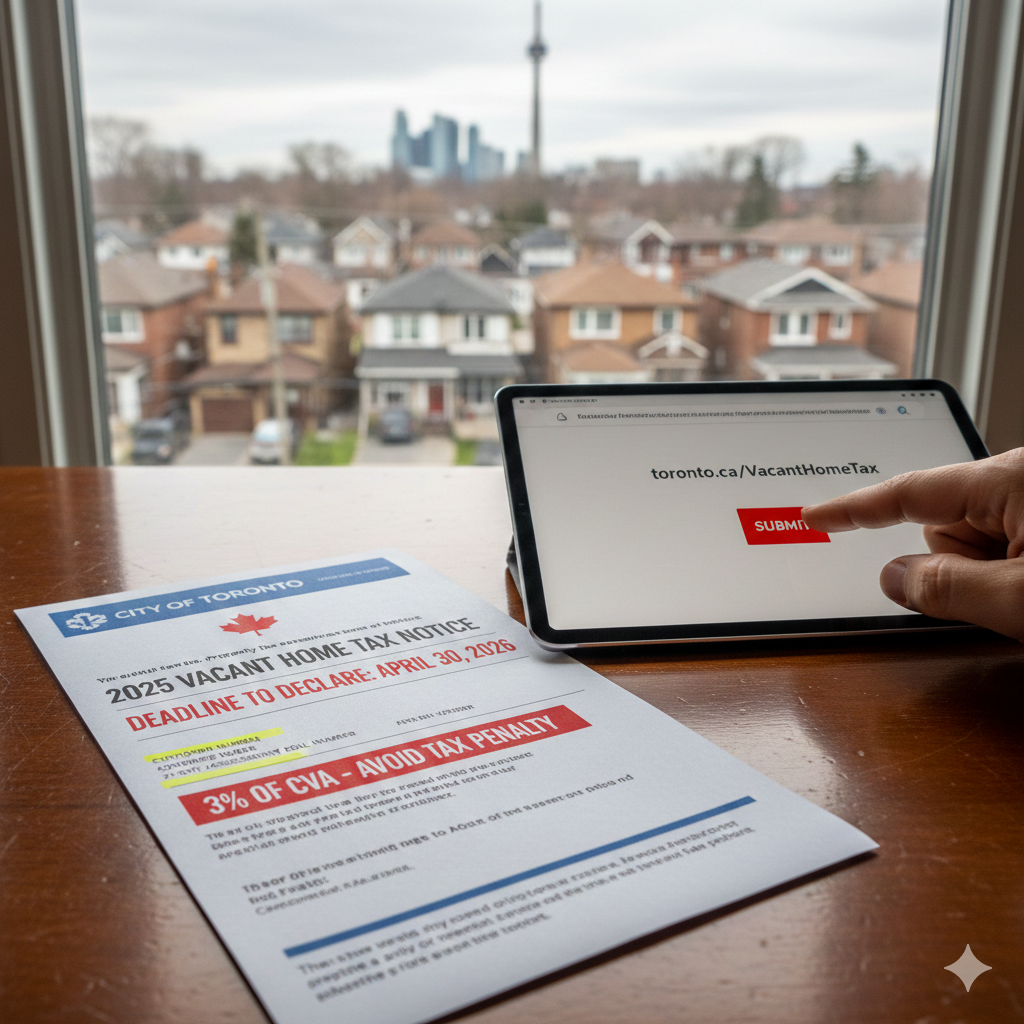

The City of Toronto has officially started sending out those yellow envelopes for the 2025 Vacant Home Tax (VHT) declarations. I’m seeing them hit mailboxes across the GTA right now. If you haven’t seen yours yet, keep an eye out; if you have, don't just toss it on the "to-do" pile.

At Connect.ca, our goal is to help you build and protect your wealth. Missing a simple filing and getting incorrectly flagged is an avoidable hit to ROI.

A common mistake is assuming “my home isn’t vacant, so I don’t need to do anything.” In Toronto, that is not how it works.

The City requires residential owners to declare occupancy status every year, including owners who live in the property or qualify for an exemption.

Have these details ready (you can find them on your property tax bill/statement or the Vacant Home Tax notice):

If you own multiple properties, you must submit a separate declaration for each one.

Online: Visit toronto.ca/VacantHomeTax

Phone: Call 311 within Toronto or 416-392-2489 from outside the city. We speak 180 languages.

In-person: Visit a Tax and Utility counter at Toronto City Hall or any civic centre.

Tip: Save your confirmation number or receipt. Declarations may be audited and documentation may be requested.

The City considers a residential property “vacant” if it was vacant for six months or more during the taxation year.

Here’s the catch: the City states a property will be deemed vacant if the owner fails to make a declaration by the deadline.

For the 2025 taxation year, the City states the Vacant Home Tax is set at 3% of the property’s Current Value Assessment (CVA) (as determined by MPAC).

If your property was vacant, you still need to declare it. The City notes that supporting documentation is required when declaring an exemption.

The City lists examples of situations that may qualify for an exemption, such as death of the owner, major renovations with permits, long-term care or hospitalization, and court orders restricting occupancy.

The City notes that if no declaration is made, the property can be deemed vacant and the Vacant Home Tax can form a lien on the property, with the purchaser held responsible for payment.

Take five minutes, submit your declaration, and save the confirmation. If you want help thinking through how VHT affects your investment strategy, rental plan, or 2026 decisions, Connect.ca can help you map it out.

Note: This is general information, not tax or legal advice.

Yes. The City requires residential owners to declare occupancy status annually, even if it is their principal residence.

The City states the property may be deemed vacant and the tax applied.

Customer number plus property address or the 21-digit assessment roll number.

Yes, but the City notes phone declarations are for occupied properties only.

The City states it is 3% of the property’s Current Value Assessment (CVA).

Source: (City of Toronto)